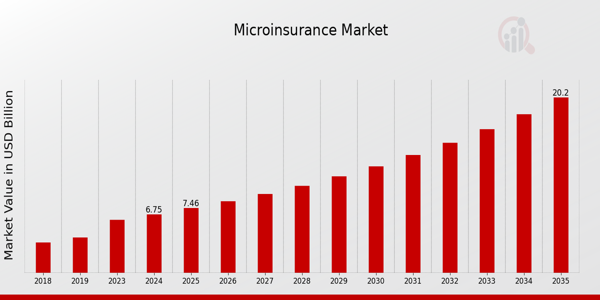

Microinsurance Market Continues to Thrive with USD 20.2 Billion by 2035

Microinsurance Market Growth

Microinsurance Market Research Report By, Product Type, Distribution Channel, Customer Demographics, Policy Duration, Regional

GA, UNITED STATES, April 8, 2025 /EINPresswire.com/ -- The global Microinsurance market has witnessed steady growth in recent years and is poised to expand significantly in the coming decade. In 2023, the market size was valued at USD 6.11 billion and is projected to grow from USD 6.75 billion in 2024 to an impressive USD 20.2 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 10.48% during the forecast period (2025–2035). The growth is primarily driven by increasing demand for affordable insurance products, rising financial inclusion initiatives, and the growing presence of insurtech solutions in underserved regions.

Key Drivers Of Market Growth

Rising Demand for Affordable Insurance Products

Low-income populations in emerging markets are increasingly seeking protection against risks such as illness, accidents, and crop failure. Microinsurance offers tailored, low-premium policies that meet these needs and provide a safety net for vulnerable communities.

Government-Led Financial Inclusion Initiatives

Governments across developing nations are actively promoting financial inclusion through programs that encourage access to microinsurance. Subsidies, policy reforms, and public-private partnerships are helping bridge the insurance gap in rural and underserved areas.

Proliferation of Digital and Mobile Technologies

The widespread adoption of mobile phones and digital wallets has revolutionized policy distribution and premium collection. Digital channels allow insurers to reach remote populations, reduce administrative costs, and offer real-time claim settlement processes.

Emergence of Insurtech Startups

Technology-driven startups are transforming the microinsurance landscape by developing innovative products, automating underwriting, and enhancing customer experience. These platforms are instrumental in expanding market access and improving operational efficiency.

Growing Awareness and Risk Mitigation Needs

With increased exposure to health risks, climate change, and economic uncertainties, people are becoming more aware of the benefits of microinsurance. As a result, more individuals and communities are opting for insurance coverage to safeguard against unforeseen events.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/11789

Key Companies in the Microinsurance Market Include

• Mutual of Omaha

• Bharti AXA

• Bima

• Zurich

• Edelweiss Tokio

• MetLife

• QBE Insurance

• Cigna

• Tata AIG

• Allianz

• MicroEnsure

• Society for Microfinance

• AXA

• Prudential

• HDFC ERGO

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/microinsurance-market-11789

Market Segmentation

To provide a comprehensive analysis, the Microinsurance market is segmented based on product type, provider type, distribution channel, and region.

1. By Product Type

• Health Insurance: Covers medical expenses and hospitalization for low-income individuals.

• Life Insurance: Offers death benefits and savings options for families in underserved areas.

• Property Insurance: Protects against losses due to natural disasters, theft, and fire.

• Crop & Livestock Insurance: Secures farmers against agricultural losses from weather, pests, and disease.

• Accident Insurance: Provides financial support in the event of accidental injury or disability.

2. By Provider Type

• Microinsurance Companies: Specialized insurers offering products specifically designed for low-income populations.

• Traditional Insurance Companies: Expanding portfolios to include microinsurance to tap into new market segments.

• NGOs & Community-Based Organizations: Partner with insurers to educate and enroll individuals in microinsurance plans.

• Government Agencies: Implement state-sponsored microinsurance programs to support vulnerable citizens.

3. By Distribution Channel

• Direct Sales: Face-to-face sales through agents and field workers.

• Mobile Platforms: Policy purchase and premium payment through mobile applications and USSD codes.

• Microfinance Institutions (MFIs): Bundle insurance with microloans and other financial products.

• Bancassurance: Distribution through bank branches and rural banking networks.

4. By Region

• Asia-Pacific: Leading market due to dense populations, strong government initiatives, and mobile penetration.

• Africa: Rapid growth driven by agricultural insurance demand and donor-funded projects.

• Latin America: Rising middle class and expanding digital infrastructure fueling market growth.

• North America & Europe: Slow but steady adoption through immigrant and low-income community programs.

• Rest of the World (RoW): Emerging interest in underserved island nations and rural economies.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11789

The global Microinsurance market is on a promising growth path, supported by socioeconomic shifts, technological innovation, and policy-level interventions aimed at increasing financial protection for low-income groups. As stakeholders continue to invest in education, outreach, and digital solutions, microinsurance is expected to play a crucial role in promoting financial resilience and inclusive growth across the globe.

Related Report:

Online Financing Platform For Smbs Market

Online Payment Fraud Detection Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release